| Indonesia |

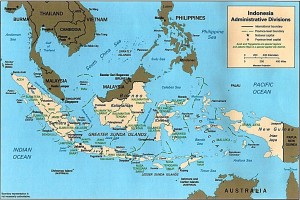

Is an archipelago comprising thousands of islands. With an estimated total population of over 252 million people, Indonesia is the world’s fourth-most-populous country. Indonesia is a founding member of ASEAN and a member of the G-20 major economies. The Indonesian economy is the world’s 16th largest by nominal GDP and the 8th largest by GDP (PPP).

At 1,919,440 square kilometers (741,050 sq mi), Indonesia is the world’s 15th-largest country in terms of land area and world’s 7th-largest country in terms of combined sea and land area. ). Included in Indonesia’s total territory is another 93,000 square kilometers (35,908 sq mi) of inland seas (straits, bays, and other bodies of water). The additional surrounding sea areas bring Indonesia’s generally recognized territory (land and sea) to about 5 million square kilometers. The government, however, also claims an exclusive economic zone, which brings the total to about 7.9 million square kilometers. Its average population density is 134 people per square kilometers (347 per sq mi), 79th in the world,

Indonesia’s location on the edges of the Pacific, Eurasian, and Australian tectonic plates makes it the site of numerous volcanoes and frequent earthquakes. Indonesia has at least 150 active volcanoes,[95] including Krakatoa and Tambora, both famous for their devastating eruptions in the 19th century. The eruption of the Toba super volcano, approximately 70,000 years ago, was one of the largest eruptions ever, and a global catastrophe. However, volcanic ash is a major contributor to the high agricultural fertility that has historically sustained the high population densities of most part of Indonesia lying along the equator; Indonesia has a tropical climate, with two distinct monsoonal wet and dry seasons.

| Economy |

Indonesia has a mixed economy in which both the private sector and government play significant roles. The country is the largest economy in Southeast Asia and a member of the G-20 major economies. Indonesia’s estimated gross domestic product (nominal), as of 2012 was US$928.274 billion with estimated nominal per capita GDP was US$3,797, and per capita GDP PPP was US$4,943 (international dollars).

The gross domestic product (GDP) is about $1 trillion and the debt ratio to the GDP is 26%. According to World Bank affiliated report based on 2011 data, the Indonesian economy was the world’s 10th largest by nominal GDP (PPP based), with the country contributing 2.3 percent of global economic output. The industry sector is the economy’s largest and accounts for 46.4% of GDP (2012), this is followed by services (38.6%) and agriculture (14.4%).

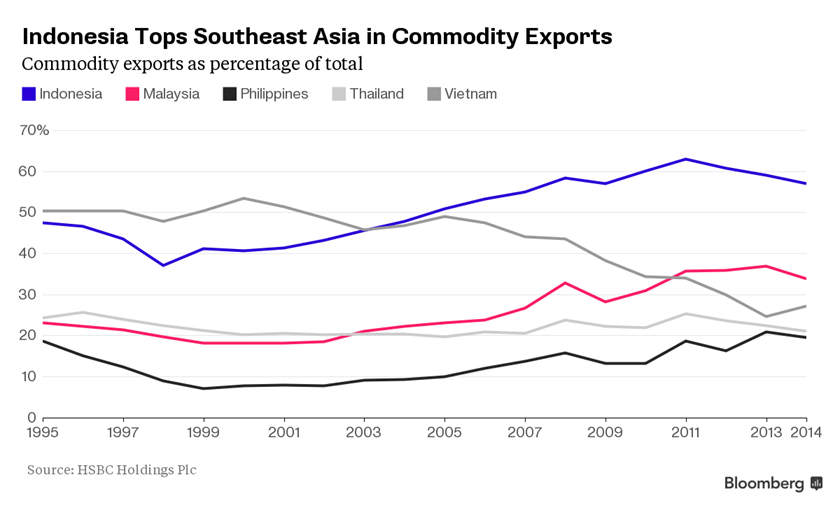

According to World Trade Organization data, Indonesia was the 27th biggest exporting country in the world in 2010, moving up three places from a year before. Indonesia’s main export markets (2009) are Japan (17.28%), Singapore (11.29%), the United States (10.81%), and China (7.62%). The major suppliers of imports to Indonesia are Singapore (24.96%), China (12.52%), and Japan (8.92%).

In 2005, Indonesia ran a trade surplus with export revenues of US$83.64 billion and import expenditure of US$62.02 billion. The country has extensive natural resources, including crude oil, natural gas, tin, copper, and gold. Indonesia’s major imports include machinery and equipment, chemicals, fuels, and foodstuffs, and the country’s major export commodities include oil and gas, electrical appliances, plywood, rubber, and textiles

| INVESTMENT IN INDONESIA |

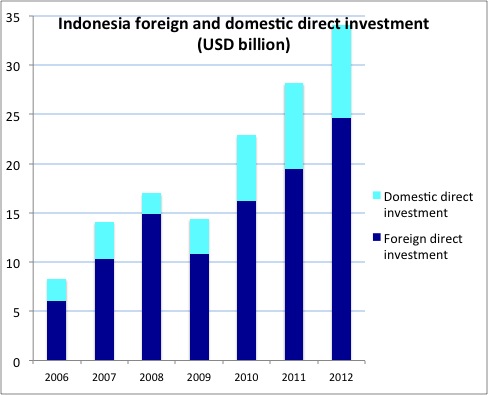

Indonesia is one of the most attractive destinations as an investment centre owing to the vast natural resources, its land mass and availability of a major workforce. Indonesia does not impose restrictions on the transfer of foreign exchange and in several sectors there are attractive tax incentives. The attractions are clear” lower labor costs, political stability and a large domestic market where consumer spending power is growing”. It seems that they are not alone. Net foreign direct and portfolio investment into Indonesia totaled US$23.2 billion on 2013, according to Official balance of payments (BOP) data and has been increasing significantly.

As in the prior three years, about 60 percent went toward foreign direct investment (FDI) in plant, equipment and other business ventures. The remainder was in the form of portfolio investment, purchases of equity and debt securities.

These are impressive numbers, at 2.7 percent of nominal gross domestic product (GDP), the net inflows exceeded those recorded by any other Asian country, with the exception of China. This is just as well” if not for the optimism, inward FDI flows may not have been as strong. The level of economic growth in Indonesia,” three largest investor countries” Singapore, Japan and the US, tends to be highly correlated with the inward FDI that Indonesia receives (in 2013, these countries accounted for 56 percent, 31 percent and 4 percent of Indonesia’s inward FDI respectively)..

At the broader level, investors can also look forward to a gradual improvement in the business environment. Some of the key issues president Jokowi wants to address are on corruption, inefficient government bureaucracy and inadequate infrastructure. On corruption, while Indonesia’s ranking has improved significantly in the last few years, it is still one of the lowest within ASEAN.

Some of these initiatives replicate policies has been forced and implemented in big cities, such as requiring performance reports from central and local government agencies and allowing the public greater access to information. The transparency of government tenders and other processes will also be increased by bringing them online.

Source: BKPM

The impact of ASEAN Economic Community (AEC)

Implemented on 31 December 2015, the ASEAN Economic Community proposes to consolidate the economic integration of the region. This review summarizes the state of the ASEAN integration, how it will benefit the private sector to do business in the region and the progress of each country towards this goal as well as to increase the stability of the economy in the ASEAN region

There are some consequences of the impact of the MEA, the impact of free flow of goods to the ASEAN countries, the impact of the free flow of services, the impact of the free flow of investment, the impact of the flow of skilled labor, and the impact of the free flow of capital.

Increased business interest in the AEC (ASEAN Economic Community)

Initiatives towards the establishment of the ASEAN Economic Community (AEC) can be traced back to as early as 1992 when ASEAN leaders mandated the creation of the ASEAN Free Trade Area (AFTA). The ASEAN Economic Community is the goal of regional economic integration by 2015. Its characteristics include: a single market and production base, a highly competitive economic region, a region of fair economic development, and a region fully integrated into the global economy

ASEAN is benefiting from a steady increase in Foreign Direct Investment (FDI), with an average growth of 14% since 2000. As the 2015 deadline of the AEC arrives, ASEAN expects business interest in the AEC to increase, as more and more businesses will benefit the ASEAN integration and develop ASEAN-centered strategies in their corporate policies.

This very positive sentiment towards business in ASEAN is shared by many local and foreign companies, as shown by the US companies’ outlook in ASEAN for 2015, and opportunities of AEC for Chinese and Hongkongese companies outlined at the Asian Financial Forum of 2014.

Positive impact to Indonesia

1. Simpler and faster customs procedure

One of the main points AEC is free flow of goods, which means there is no barrier tariff barriers, in addition Directorate General of Customs and Excise will also implement the ASEAN Single Window that will ease any export import process between ASEAN countries. Indonesia already has experience of using this system is proven to smooth the process of export-import.

2. A self-certification system implementation

It is a system that allows the exporter stating the authenticity of their own products and enjoy preferential tariff scheme under the ASEAN-FTA (Free Trade Area). It is mentioned in the regulations of the Ministry of Finance of Indonesia Number 178 / PMK.04 / 2013 dated December 9, 2013 concerning the imposition of duty in the scheme Tariff ASEAN Trade in Goods Agreement (ATIGA) using a self certification and are further explained in Director General of Customs and Excise regulation No. PER-02 / BC / 2014 on Procedures for the Imposition of Import Tariff scheme of ASEAN in Goods Agreement (ATIGA) using independent certification system.

The success and a significant increase of the Indonesian economy, not apart, and relates to some of the leading sectors in Indonesia, and these sectors are also well-known in Indonesia, such as:

| COFFEE |

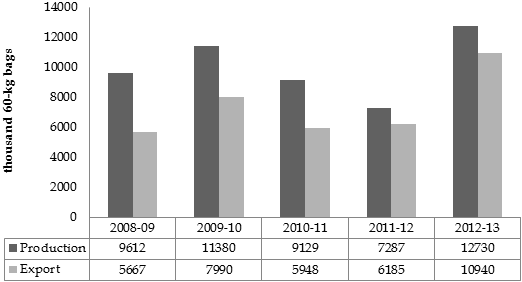

Indonesia was the fourth largest producer of coffee in the world in 2014.Coffee in Indonesia began with its colonial history, and has played an important part in the growth of the country. Indonesia is located within an ideal geography for coffee plantations, near the equator and with numerous mountainous regions across the islands, creating well suited micro-climates for the growth and production of coffee.

Indonesia produced an estimated 540,000 metric tons of coffee in 2014, of this total, it is estimated that 154,800 tons was required for domestic consumption in the 2013/2014 financial year. Of the exports, 25% are Arabica beans; the balance is Robusta. In general, Indonesia’s Arabica coffees have low acidity and strong body, which makes them ideal for blending with higher acidity coffees from Central America and East Africa. The main markets are the United States, Western Europe and Japan, but demand from emerging markets such as Russia, China, Taiwan, South Korea and Malaysia is increasing significantly

According to data from the Indonesian Coffee Exporters Association (AEKI), Indonesian farmers in cooperation with the relevant ministries are currently planning to expand Indonesia’s coffee plantations, while rejuvenating old plantations through intensification programs. By increasing acreage, Indonesia’s coffee production in the coming ten years is expected to reach between 900,000 and 1.2 million tons per year. As both global and domestic demand is rising, investment in the country’s coffee sector is needed. Besides increasing quantity of the beans, quality is also expected to increase due to technological innovations. Coffee production per hectare is still low compared to other large coffee producing countries. In 2012, Indonesia produced 0.76 tons of coffee per hectare, while in Vietnam the figure was 3.5 tons and in Brazil 6.5 tons per hectare. Government and other players in Indonesia’s coffee industry aim to increase productivity per hectare to over 1 ton in the years ahead and the opportunity for growth and export is large and growing.

Source: International Coffee Organization

Source: International Coffee Organization

One of the biggest coffee producers and best coffee in Indonesia is from Sumatera; Sumatera is an island at the western point of Indonesia, which is famous for its coffee production. Many of the well-known Arabica are produced here and have been the world famous coffee produced in the area and the world. All Arabica from Sumatera is processed with the same technique: wet-hull. The method is uniquely only be done in Indonesian coffee production. There is no other place outside Indonesia processed their coffee with this wet-hull technique.

The dry fragrance has a distinctive characteristic of spicy sweet quality, milky caramel, and some woody tones. It has a bold mouthfeel with low acidity. In some case, you can feel a crisp aromatic wood and nutty flavor and considered as extra bold.

| FORESTRY/PLANTATIONS |

Indonesia is among the world’s leading wood products exporters, and is the leading plywood exporter. The forest sector has grown rapidly in the last three decades to 487 concessions occupying 56 million hectares. A notable change in recent years has been the rapid growth of the pulp and paper industry. The extraction of timber from concessions is over 40 million cubic metres per year whereas the government-determined threshold for sustainable production is 22 million cubic metres per year. Non-wood forest products account for 1-5% of forest sector export income. Rattan production, like that of timber, has been subject to dramatic transformation through the implementation of value-added policies and Indonesia has become the world’s leading supplier of rattan furniture.

Indonesia has increased per capita GDP year on year. Its sustained growth has in part been due to its large natural resources base, including forests. Indonesia is home to some of the most extensive forest land in the world. Forests and forestry have played a large part in Indonesia’s broader economic development over the past five decades.

The industry has expanded from craft enterprises and local lumber businesses to an internationally competitive sector. The forestry sector has for the larger part moved from localized selective felling for to large-scale plantation development. The forest-based manufacturing industry has diversified from small manufactures to large-scale plywood production and most recently pulp and paper production.

The contribution these combined sectors – forestry, wood manufacturing and the pulp and paper industry – cannot be underestimated.

– Combined, the sectors contribute approximately USD 21 billion to Indonesia’s GDP, or roughly 3.5 per cent of the national economy;

– Wood products and pulp and paper manufacturing represent around 8.3 per cent of manufacturing value-added;

Wood and wood manufacturing contributed USD 9 billion (around 1.4 per cent) to Indonesia’s GDP in 2009. Its share of manufacturing value added was around 2.3 per cent in the same year. According to one estimate the subsector directly employs more than 1.3 million people. The sector also makes up around 4 per cent of total non-mineral exports.

| BIOFUEL (SUSTANAIBLE ENERGY) |

Biofuel is a renewable energy source that is produced from recently living organisms or their byproducts. The term itself is most commonly used to refer to liquid biofuels. They are fuels developed from specifically grown agricultural products.

Before World War II, biofuels were seen as providing an alternative to imported oil in European countries. After the war, cheap Middle Eastern oil lessened interest in biofuels. But since the 21st century, rising oil prices, concerns over the potential oil peak, global warming, and instability in the Middle East are pushing renewed interest in biofuels.

Indonesia’s rich biodiversity and vast potential for development of the bioenergy utilization, together with the integrated strategy and incentives for investment developed by the government, favorably position the country to maximize the promise of sustainable long-term returns from the biofuel economy. Indonesia is currently focusing on developing Liquid Biofuel derived from Jatropha Curcas, Palm Oil, and Sugar Cane.

GOVERNMENT INITIATIVES

The Indonesian Government made a firm commitment to the development of biofuel potential in the country. Presidential Instruction (InPres) no. 1/2006 was issued for the provision and utilization of biofuel in Indonesia as an alternative energy source.

An integrated strategy for implementation of the biofuel program has been developed. Special fiscal incentives are also being provided by the Indonesian Government, on top of investment guarantees and protections to encourage foreign and national investments.

To further expedite Indonesia’s adaption of biofuel, The National Biofuel Development Team (TimNas BBN) was formed. Another facet of Indonesia’s biofuel development program is the mapping of the Special Biofuel Zone.

| Palm Plantation (Palm Oil) |

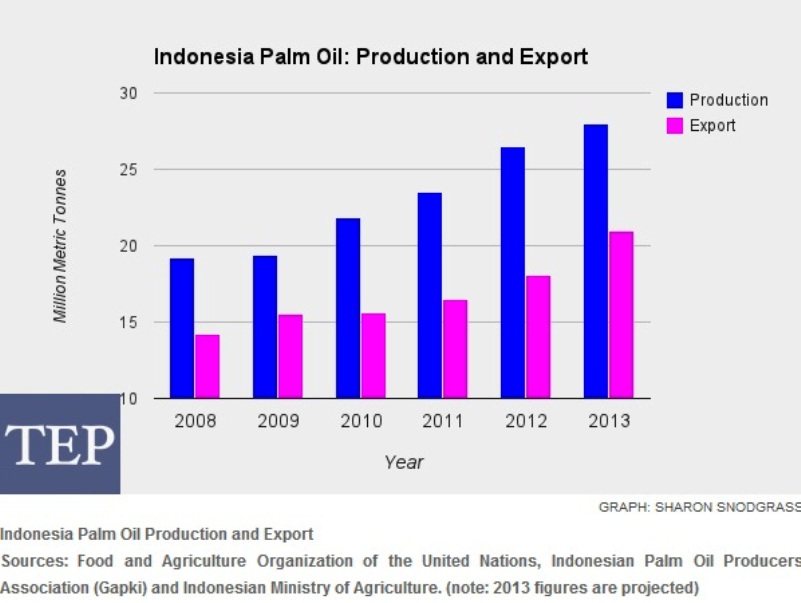

Economic Benefits of Palm Oil The palm oil industry has the potential to generate significant economic and social development in Indonesia. Palm oil is Indonesia’s second most successful agricultural product, after rice paddy, and largest agricultural export. It provides a means of income and economic development to a large number Indonesia’s rural poor. The Indonesian palm oil industry is expected to continue its rapid growth in the medium-term. The global market for palm oil has experienced rapid growth in recent decades with current production of palm oil estimated at over 45 million tonnes. Indonesia is one of the world’s largest producers and exporters of palm oil, producing over 18 million tonnes of palm oil, annually,

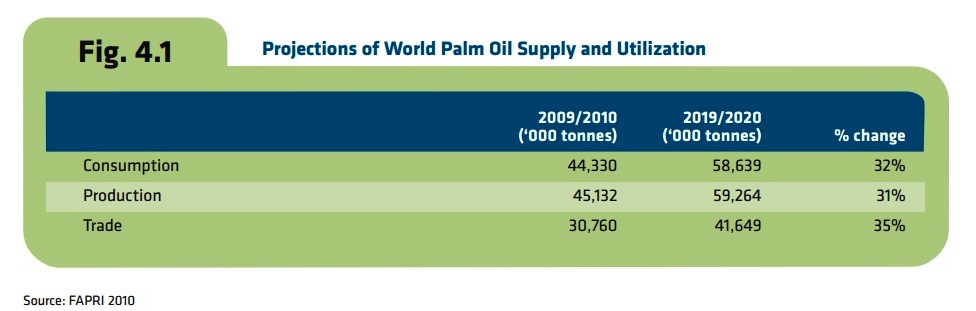

With global demand for palm oil expected to grow further into the future, palm oil offers the most promising economic prospects for Indonesia. World production of palm oil is expected to increase by 32 percent to almost 60 million tonnes by 2020.

The palm oil industry has experienced rapid growth in recent decades, and has become a significant contributor to the world market for vegetable oils. Demand for palm oil has further increased in recent years as many developed economies are shifting away from the use of trans-fats, to healthier alternatives. Palm oil is often used as a substitute for trans-fat as it is one of the few highly saturated vegetable fats that are semi-solid at room temperature, and is relatively low cost

Palm Oil impact and positive development in the world

Total world production of palm oil has increased almost threefold over the past 3 decades to 20091. In 2009/10, total palm oil production was estimated at 45.1 million tonnes, with Indonesia and Malaysia accounting for more than 85 percent of the world total. Indonesia and Malaysia each produced over 18 million tonnes of palm oil. Total trade in palm oil and palm kernel oil is over 35 million tonnes, imported and exported. Major exporters of palm oil include Indonesia and Malaysia who exported 15.7 and 15.1 million tonnes, respectively. Key importing economies included India, China and the European Union, who imported 6.7 million, 6.3 million and 4.6 million tonnes, respectively

Approximately 80 percent of global palm oil production is used for food purposes including as cooking oil, in margarines, noodles, baked goods etc. In addition, palm oil is used as an ingredient in non edible products including in the production of bio-fuel, soaps, detergents and surfactants, cosmetics, pharmaceuticals and a wide variety of other household and industrial products. In 2009, the world consumed approximately 6.5 kilograms of palm oil per capita, annually. Palm oil and palm kernel oil uses, in both food and non-food products, have been growing significantly. By 2020, global consumption of palm oil is expected to grow to almost 60 million tonnes.

Palm oil’s increasing contribution to the bio-fuels industry is also stimulating further demand. However, this demand is relatively low as compared with other sources as palm oil currently accounts for less than 5 percent of the world’s bio-diesel production. Approximately 95 percent of the world’s energy consumption is sourced from fossil fuels; by 2030 energy consumption is expected to increase by a further 50 percent. Many economies are setting targets to convert reliance on fossil fuels to greater use of renewable energy in efforts to reduce GHG emissions.

One such renewable energy source that has grown significantly over the last decade is bio-fuel. Palm oil is widely used as a feedstock in bio-diesel production. Although dependent on government policies, the increased use of bio-fuels is expected to facilitate further demand growth for palm oil. The OECD is expecting the global usage of vegetable oils in bio-diesel production to more than double between 2006-08 and 2018. Palm oil is the most cost competitive vegetable oil for producing bio-diesel. Many economies are currently adopting policies that encourage the use of bio-fuel.

If such blending mandates are enforced an extra 4 million hectares of oil palm would be needed to meet European Union requirements alone. A further one million hectares may be needed to satisfy China’s requirements, making bio-fuel production even more attractive. Investment in bio-diesel processing capacity is increasing; the Indonesian and Malaysian governments have introduced policies to develop a bio-diesel industry and targets of allocating 6 million tonnes of palm oil to the industry each year

Contribution to Indonesia

Palm Oil’s Contribution to the Indonesian Economy Palm oil is Indonesia’s second largest agricultural product; in 2008, Indonesia produced over 18 million tonnes of palm oil. For the last decade, palm oil has been Indonesia’s most significant agricultural export. In 2008, Indonesia exported over $14.5 billion in palm oil related products. The Indonesian palm oil industry has experienced significant growth in recent years with approximately 1.3 million ha of new area dedicated to palm oil plantations since 2005, reaching almost 5 million ha in 2007 (representing 10.3 percent of the 48.1 million ha of agricultural land).

Future Prospects for Global Palm Oil

Demand increased returns from a strong global demand for vegetable oils are expected to encourage investment in the palm oil industry leading to continued growth over the medium term, with global consumption expected to increase over 30 percent in the next decade. By 2020, global consumption and production of palm oil is expected to increase to almost 60 million tonnes. The health characteristics and cost competitiveness of palm oil, coupled with its potential contribution to renewable energy, is expected to contribute to a growth of over 30 percent in the next decade.

Growth in the palm oil industry has been contributed to by the production cost advantages in oil palm cultivation. Oil palms are a highly productive tree crop in comparison to crop based oil seeds—oil yields are 5 to 9 times higher than the yields achieved by soybean, rapeseed and sunflower. There are cost advantages in oil palm from lower land prices and lower energy inputs. As developed economies shift away from trans-fats towards healthier alternatives, the demand for palm oil will also likely increase relative to its competitors.

In the last few years, many developed economies have moved towards reducing and banning trans-fats, as a result many food manufacturers have replaced trans-fats with palm oil. In addition to being cost competitive, palm oil is high in mono-unsaturated fats which are considered to be advantageous for a lower risk of heart disease. As well as total increased total consumption, per capita consumption of vegetable oils has been increasing in some major developing economies due to strong income growth. Palm oil has benefited from this development due to its relatively high energy per gram of food. In 2009-10 China and India accounted for over 40 percent of the net imports in world trade. Future economic growth in these countries will increase the demand for imported vegetable oils

| RUBBER |

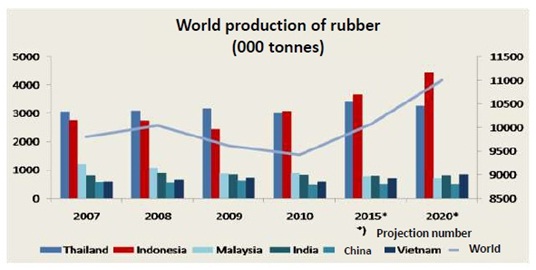

As the second-largest rubber producer, Indonesia supplies a substantial amount of rubber to the global market. Since the 1980s, the Indonesian rubber industry has been experiencing steady production growth. Most of the country’s rubber output – approximately 80 percent – is produced by smallholder farmers. Government and private estates thus play a minor role in the domestic rubber industry

The total size of Indonesia’s rubber plantation area has risen steadily during the last decade. In 2015, the country’s rubber plantations covered a total of 3.65 million hectares. As prospects of the rubber industry are positive, there has been a shift away from commodities such as cocoa, coffee and tea, in favor of the establishment of palm oil and rubber plantations. Smallholder rubber estates have increased, while government and private rubber estates have shown a slight decrease, probably due to a shift in focus to palm oil.

Around 85 percent of Indonesia’s rubber production is exported. Almost half of export is shipped to other Asian countries, followed by North America and Europe. The top five Indonesian rubber importing countries are the USA, China, Japan, Singapore and Brazil. Domestic rubber consumption is mostly absorbed by Indonesia’s manufacturing industries (in particular the automotive sector).

| AN EXCELLENT INVESTMENT DESTINATION |

With the facts and information above, it is clear that Indonesia is an excellent and promising country for investments and business opportunities. The positive investment realization achievement year after year created high optimism in Indonesia’s future investment prospect, furthermore, Indonesia is a very attractive business and investment destination, abundant natural resources, a young and technically trained work force, low cost and a large and growing domestic market, combined with an improving investment climate and a higher global profile, are just a few of its salient strengths.

With stability firmly planted after over 10 years of vibrant democratic rule, Indonesia’s vast economic potential is primed for takeoff, added with that, Indonesia as a leading member of ASEAN, shaping integrative approaches in the region for security, trade and commerce, and will be the integral part of the ASEAN Economic Community in 2015. Finally, Indonesia is emerging as a key player on cross-cutting international policy issues as climate change, which will have direct and indirect impacts on business and investment decisions. We welcome you as a partner in reaching for a more prosperous future

| WHAT WE OFFER |

To support the global investment which we describe above will definitely requires media or means in order to connects investors with businesses or investments opportunities in Indonesia and help make it happen thoroughly, so that’s where our presence with our optimal form of services, professional and thorough in the area of:

• Licenses arrangements/handling Service

Company establishment licensing, stay permit, Legal documents revisions and changes, land purchases permit, license for industry, business permit, land management permit, Industrial forest permit, export-import permit, property permit

• Land or business area search service

Information and data on available land, for property, vacant land, plantations or forestry, industrial area

• Business Partner

Become a business partners, business coaching, business analysis, JV

• As a supplier for Sumatera Coffee

We are a professional service firm who have extensive experience in the field of licensing, business or business expansion as well as in the business management field for plantation, forestry and property, we have a broad network and well connected links which given a better, efficient and effective result and outcome, and certainly for our clients will be more easier and lower costs, our motto is “Maximum impact, highest result in affordable cost”

please contact us for inquiries